I recently got back from a short holiday in Canberra, our nation’s capital. Amongst other touristy things, we visited Old Parliament House, where there is an Australian Democracy Museum. One of the displays is on the past Prime Ministers, and when you see them all together, you realise that we’ve had a lot of them, in the century and a bit that we’ve run our own parliament.

I recently got back from a short holiday in Canberra, our nation’s capital. Amongst other touristy things, we visited Old Parliament House, where there is an Australian Democracy Museum. One of the displays is on the past Prime Ministers, and when you see them all together, you realise that we’ve had a lot of them, in the century and a bit that we’ve run our own parliament.

In fact, from 1901 to 2010, we’ve had 31 changes of government. For those not doing the math as we go along, that’s one every three and a half years.

And for someone who is, say, 35 years old, and facing 25 years before they can get access to the money in their superannuation, there’s an expected 7 or so new governments that will have a chance to meddle with it in the mean time.

The risk of current and future governments impacting the performance of an investment through passing laws is called Legislative Risk. Unfortunately, laws that affect superannuation have been prime candidates in the past for government fiddling. In the future, given the rumours about the Henry Tax Review, it will almost certainly get further tweaking still.

If you’re an employee, participation in superannuation is compulsory, where 9% of the total salary package (or thereabouts) is locked away in the system. Unless employees are willing to go to the expense and effort of setting up a Self Managed Super Fund, their money is generally invested in Australian stocks and bonds. So, if you want to invest in say fine art, residential property, a family company or venture-capital backed start ups, you aren’t going to get any joy with super.

Despite the limited investment options and the long period that you can’t directly benefit from it, an investment in your superannuation gets beneficial tax treatment. This is its key advantage, and the very thing that is vulnerable to legislative risk – a risk that is real, based on past actions and rumoured future actions of our governments.

I think that most Australians would benefit from having some level of investment outside of superannuation (even if it’s just their home), in order to reduce their exposure to this risk.

Related articles by Zemanta

- Australia Pensions Facing ‘Disaster’ on Shortfall, Study Says (businessweek.com)

- A Walkabout the Aussie Housing Market (blogs.wsj.com)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=09ea4120-47f0-4929-b249-353562af7eb4)

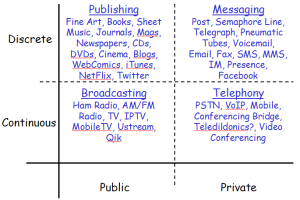

One of the first observations is that all of these examples of communications require some sort of network. The different quadrants have different types of networks, clearly. I’m interested in seeing if there are some common characteristics shared by the examples in the e.g. public or discrete categories.

One of the first observations is that all of these examples of communications require some sort of network. The different quadrants have different types of networks, clearly. I’m interested in seeing if there are some common characteristics shared by the examples in the e.g. public or discrete categories.![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_e.png?x-id=57ef8ddb-39b0-417f-9c8a-b4593a666d27)